Gold is a precious metal that has been prized by humans for centuries. Its lustrous color and malleability make it ideal for jewelry and other decorative uses, and it is also a valuable conductor of electricity.

Gold is also frequently used as a financial investment, as it tends to hold its value better than many other commodities. But how much is a pound of gold worth today? Let’s take a look at the current market value and how it has changed over time!

What Makes Gold so Valuable?

Gold is one of the most valuable elements on Earth. It is rare, durable, and has a wide range of uses. Gold is rare because it is not often found in nature. It is usually found in small quantities, mixed with other metals such as silver or copper. This makes it difficult to mine gold, and the process can be expensive.

Gold is also durable, meaning it does not corrode over time. This makes it a good choice for making jewelry and other objects that will be exposed to the elements. In a pure form, it is a bright, slightly reddish yellow, dense, soft, malleable, and ductile metal. Humans are physically and emotionally drawn to it, partly because different societies have placed a tremendous amount of value in gold. All these factors combine to make gold a valuable commodity.

In the past, a gold standard was often implemented as a monetary policy, but gold coins ceased to be minted as a circulating currency in the 1930s, and the world gold standard was abandoned for a fiat currency system after 1971.

Today, gold is often seen as a good investment because it tends to hold its value in the face of inflation. Over time, the price of goods and services increase, but the purchasing power of gold remains relatively stable. This makes gold a good hedge against inflation. For all these reasons, gold remains a popular investment today.

Is Gold a Good Investment?

For many people, gold is seen as a safe investment. Unlike stocks and bonds, gold isn’t subject to the ups and downs of the stock market. And because gold is a physical commodity, it can’t be created or printed like money. For these reasons, gold has traditionally been used as a way to protect wealth from inflation. Gold is also portable and easy to trade, making it a good choice for investors who are looking for liquid assets.

In addition, gold is often used as a hedge against currency fluctuations. When the value of paper currency goes down, the pound of gold price usually goes up. This makes gold a good investment for people who are worried about the current state of the economy.

However, there are also some drawbacks to investing in gold. Because it is a physical commodity, gold is subject to theft and other forms of loss. Gold prices can also be volatile, and they typically don’t provide any income or dividend payments. For these reasons, some investors prefer to invest in other assets such as stocks or real estate.

How is Gold Priced?

There are a few different ways that gold is priced. The most common is the spot price, which is the current market price for an ounce of gold. The spot price changes constantly, based on supply and demand.

The fixed price is the price that gold coins are sold for by dealers. This price is usually slightly higher than the spot price, to cover the dealer’s overhead costs.

Futures contract prices are set in advance for gold that will be delivered at a future date. These contracts are traded on commodities exchanges, and the price is based on the spot price at the time of the contract. The futures price can be higher or lower than the spot price, depending on market conditions.

Sources of Pricing

When it comes to pricing gold, there are three main sources: Over-the-counter (OTC) markets, large banks, and bullion traders.

OTC markets are the most common source of pricing information, as they provide real-time data on gold prices around the world. Large banks also play a significant role in setting gold prices, as they often buy and sell large quantities of the metal. Bullion traders are another important source of pricing information, as they buy and sell gold on a regular basis.

All three of these sources provide valuable information on gold prices, which can help investors make informed decisions about their investments.

What are Troy Ounces?

A troy ounce is a unit of measurement that is traditionally used for precious metals like gold, silver, and platinum. One troy ounce is equivalent to 31.1 grams. On the other hand, a troy pound is a unit of mass that is equal to 12 troy ounces.

Most people use the terms “ounce” and “pound” when referring to gold, even though the troy ounce and pound are actually slightly different from the standard units.

The troy ounce gets its name from the French city of Troyes, which was once a major center for the trade of precious metals. In medieval times, English kings often purchased gold and silver from French jewelers using troy ounces as the unit of measurement. The troy ounce is still used today by jewelers and bullion dealers.

However, it should not be confused with the avoirdupois ounce, which is a slightly different unit of measurement. The avoirdupois ounce is used for weighing non-precious items like produce and spices. In most cases, one avoirdupois ounce is equal to 28.35 grams.

Unit |

Metric weight |

Ounces as defined per pound |

Uses |

Troy ounce |

31.10 grams |

12 |

Precious metals, gemstones, etc |

Avoirdupois ounce |

28.35 grams |

16 |

Everyday items |

When buying precious metals, be sure to ask whether the price is being quoted by the troy ounce or the avoirdupois ounce. Otherwise, you may end up paying more than you bargained for.

How Do You Convert an Avoirdupois Ounce into a Troy Ounce?

Converting between different units of measurement can seem confusing at first, especially when dealing with precious metals. To convert an avoirdupois ounce into a troy ounce, simply multiply the amount in avoirdupois ounces by .91. For example, if you have 2 ounces of gold that you want to sell, you would need to sell it as 1.82 troy ounces in order to get the correct weight.

How Much is a Pound of Gold Worth?

The price of gold is currently sitting at $1,874 per troy ounce, which equates to approximately 22.488 per pound ($1,874 x 12, since there are 12 troy ounces in a pound).

You can use this equation to calculate the fluctuating pound of gold price, or you can see how much is 1 pound of gold worth today on a website like Kitco. Of course, this is just the raw price of gold and does not take into account the cost of refining it or any other fees associated with selling it.

What Was the Highest Price of Gold in History?

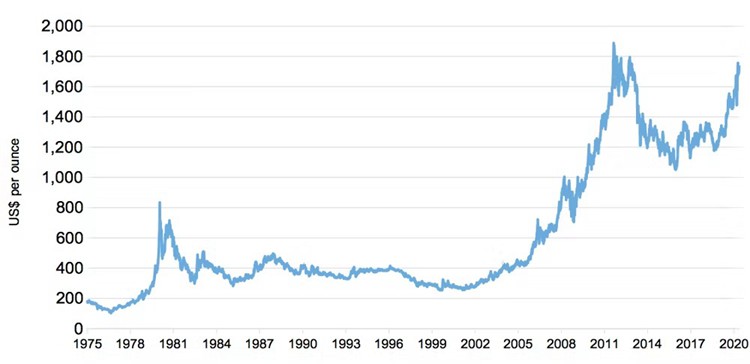

When the economy is weak or Uncertain, demand for gold typically rises, as investors seek out a safe haven for their money. In 2020, the coronavirus pandemic caused economic uncertainty around the world, leading to a surge in demand for gold. As a result, the price of gold reached an all-time high of $2,032.16 USD per troy ounce in 2020.

While the price has since pulled back from these highs, it remains well above its pre-pandemic level and is expected to continue to be volatile in the coming years.

Factors That Affect How Much is 1lb of Gold Worth

Gold is a precious metal that has been used as a form of currency, jewelry, and investment for centuries. The price of gold is determined by a number of factors, including supply and demand, inflation, and global economic conditions. The price of gold tends to be volatile, and it can fluctuate significantly in a short period of time.

Supply and Demand

The price of gold is determined by the law of supply and demand. When the demand for gold is high and the supply is low, the price of gold goes up. On the other hand, when the demand is low and there is a lot of gold available, the price goes down.

The reason demand affects the price more than supply has to do with how gold is produced. Gold is mined out of the ground, and it takes a lot of effort to find and extract it. Once it’s been mined, it can be sold over and over again without ever being used up. So, if more people want to buy gold than there is available, the price will go up. However, if there isn’t much demand for gold, then miners will stop looking for it because it’s not worth their time and effort. That’s why supply and demand have such a big impact on the price of gold.

Inflation

Inflation is a general increase in prices and fall in the purchasing value of money. When inflation rises, every dollar buys fewer goods and services. The relationship between gold and inflation is complex, however, because gold doesn’t necessarily move in tandem with other inflationary indicators such as the consumer price index (CPI).

In general, when inflation increases, the price of gold also goes up. This is because gold is seen as a hedge against inflation. As the cost of living goes up, the value of gold goes up as well.

Interest Rates

Gold is often seen as a safe investment during times of economic uncertainty. When interest rates are low, gold prices tend to rise, as investors seek out alternative ways to preserve their wealth. Conversely, when interest rates are high, lb of gold price usually falls, as investors are willing to accept lower returns in exchange for the stability of cash deposits.

Government Reserves

When governments buy or sell gold, this can have a significant impact on the market price. If governments are selling gold, this can cause the price to fall, as there is more gold available on the market. Conversely, if governments are buying gold, this can drive prices up, as there is less gold available for purchase.

This is one of the reasons why central banks and other government institutions often hold large reserves of gold, as they can use these reserves to influence prices.

Geopolitics

Political stability and unrest in different parts of the world can influence the demand for gold. When tensions rise between countries or regions, investors often flock to gold as a safe haven asset. This demand drives up prices, causing gold to surge in times of geopolitical turmoil. Conversely, when relations improve and tensions ease, lb of gold price tends to fall.

Relation With Other Assets

One of the most important drivers of gold prices is the demand for other asset classes, such as stocks and bonds. When investors are feeling confident about the future, they tend to put more money into stocks and other risky assets. On the other hand, when investors are feeling less confident about the future, they may put more money into safe-haven assets like gold. This can lead to lower gold prices.

How Often Does the Price of Gold Change

The price of gold is notoriously volatile, and it can fluctuate quite dramatically on a day-to-day basis. However, over the long term, the price of gold tends to be relatively stable. In general, the price of gold is driven by demand and supply. When demand is high and there is limited supply, the price of gold will go up. Conversely, when demand is low and there is an abundance of supply, the price will go down.

However, given the complex nature of the global economy, even the best experts can only make educated guesses. As a result, the best way to stay up-to-date on the latest changes in the price of gold is to follow news and updates from reliable sources.

Will Gold Ever Lose Its Value

Gold has been used as a form of currency for centuries, and its value has remained relatively stable over time. However, there are some factors that could potentially lead to a decrease in the value of gold. For example, if the economy improves and inflation is kept under control, investors may be less likely to invest in gold as a hedge against inflation.

Additionally, new discoveries of gold deposits could lead to an increase in the supply of gold, which could also put downward pressure on prices. Ultimately, the future value of gold is impossible to predict with certainty. However, as long as it continues to be scarce and desired by investors, it is unlikely that gold will lose its value completely.

FAQ

What is the best way to invest in gold?

One of the oldest and most popular ways to invest in gold is to purchase physical gold bars or coins. The appeal of this method is that it offers a tangible asset that can be stored and accumulated over time. Gold bars and coins can be easily bought and sold, and they provide a convenient way to invest in gold without having to worry about the complexities of futures contracts or mining stocks.

Is the price of gold the same all over the world?

The price of gold is the same all over the world. This is because the price of gold is based on the spot price, which is set by the global market.

Can you make money by investing in gold?

For centuries, gold has been regarded as a valuable commodity, and its value has only increased in recent years. Consequently, many people have turned to gold as a way to invest their money and earn a return. While there are some risks involved in any investment, by carefully researching the gold market and making wise decisions, it is possible to make a profit from investing in gold.

Which gold is best to buy ?

For many investors, physical gold bullion is the preferred choice. Bullion is gold in the form of coins, ingots, or bars. It is typically at least 99.5% pure and is often used as a hedge against inflation or economic uncertainty.

Final Thoughts

Gold is a rare and precious metal that has been prized by cultures around the world for centuries. Its distinctive color and luster make it an ideal material for jewelry and other decorative items, and its resistance to tarnish means that it can be used for a wide variety of purposes.

Today, gold is still highly valued, and its price is determined by the market. Gold is typically measured in troy ounces, with one troy pound equaling 12 troy ounces. The current price of gold is $22.488 per pound, making it a valuable commodity indeed.

You can purchase gold bullion or buy stocks in gold mining companies. If you’re interested in investing in gold, do your research to find the best way to do it given your circumstances and risk tolerance. Talk to a financial advisor if you need help getting started. Investing in gold can be a smart move that pays off in the long run.

Wednesday 6th of March 2024

10"XOR(1*if(now()=sysdate(),sleep(15),0))XOR"Z

1-1); waitfor delay '0:0:15' --

Wednesday 6th of March 2024

1

1-1; waitfor delay '0:0:15' --

Wednesday 6th of March 2024

1

Wednesday 6th of March 2024

1